PAYE or Umbrella

There are two types of payroll options – PAYE or an Umbrella Company. Different methods of pay will best suit different people. You need to consider what is best under your particular circumstances.

What is PAYE?

Pay as You Earn (PAYE) is the UK’s system of paying Income Tax and National Insurance contributions. This is handled by your agency who will deduct the relevant percentage from your wages each time before paying you and send this contribution on to HM Revenue & Customs.

What is an Umbrella Company?

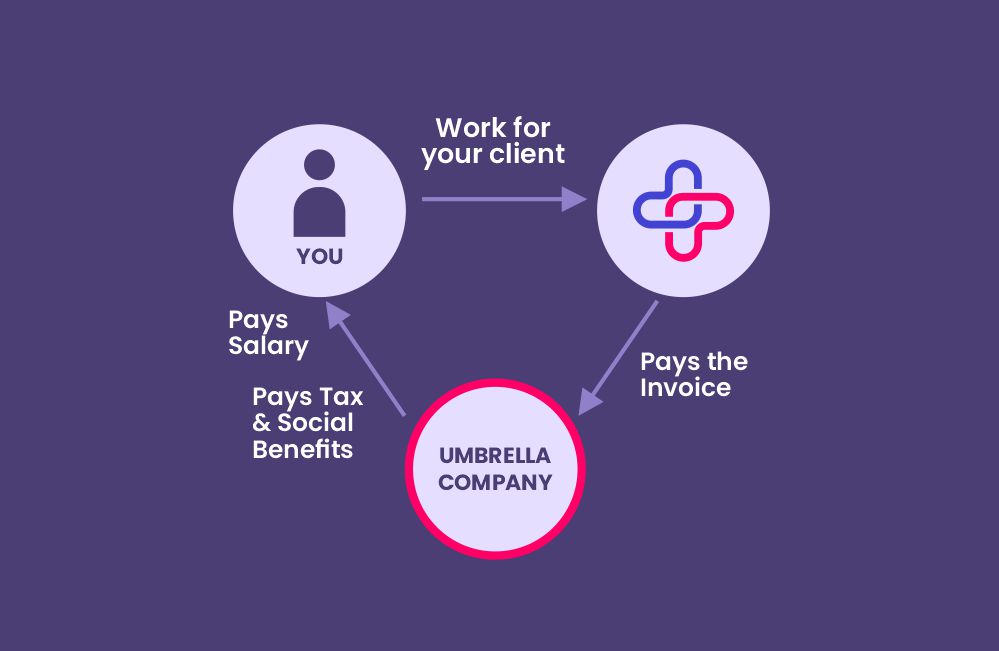

An Umbrella company is an intermediary that acts as your employer to process your pay, rather than the agency you work through.

You submit your timesheet along with any expenses to PremiumLine Healthcare.

PremiumLine Healthcare pays your chosen Umbrella company.

Umbrella company transfers your pay directly into your bank account.

If you work through multiple agencies, this may be the best option for you.

All Umbrella companies use the same PAYE calculations to ascertain how much tax should be paid. The only difference between Umbrella companies will be the benefits they offer and the fee they charge. We only use umbrella companies who have passed our strict compliance checks.

For the full list of approved suppliers, please contact the payroll team on 01372860844 | 07851113995 or via email at finance@premiumlinehcs.co.uk It is worth doing some comparison work to make sure you choose the one that will work best for you. If you are still unsure about how to proceed, your consultant at PLHCS will be more than happy to help.